If you’re familiar with personal finance guru Dave Ramsey, you’ve probably heard of his debt snowball method for paying off debt. This method involves listing all your debts from smallest to largest and then focusing on paying off the smallest debt first while making minimum payments on the rest. Once the smallest debt is paid off, you roll that payment amount into the next smallest debt, creating a “snowball” effect that helps you pay off debt faster.

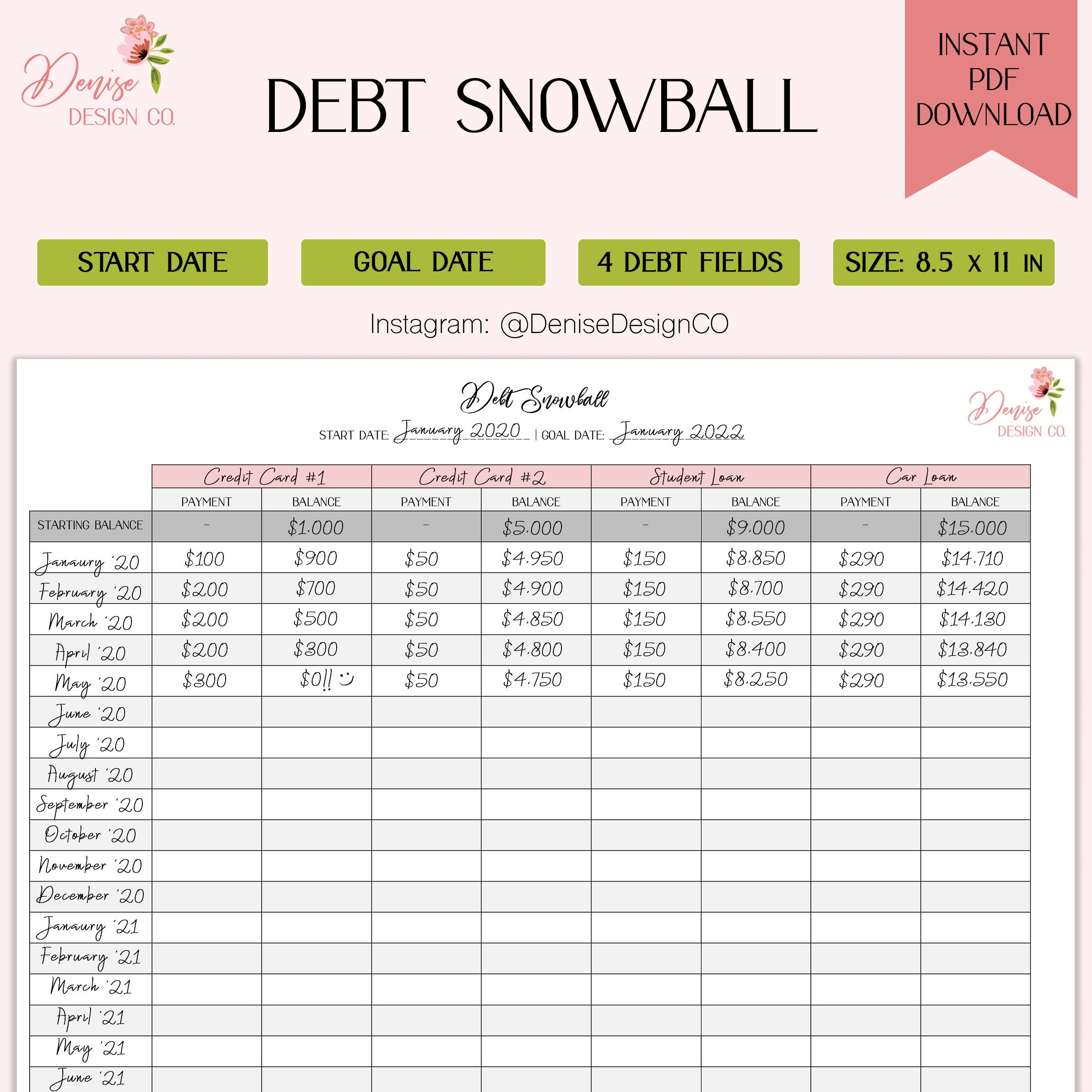

One of the key tools that Dave Ramsey recommends for tracking your debt snowball progress is a printable snowball tracker. This printable worksheet allows you to visually track your debts, payments, and progress as you work towards becoming debt-free. By using a snowball tracker, you can stay motivated, see your progress, and stay organized throughout your debt payoff journey.

How to Use the Dave Ramsey Snowball Tracker Printable

Using the Dave Ramsey Snowball Tracker Printable is simple and straightforward. Start by listing all your debts in order from smallest to largest, including the current balance, interest rate, and minimum payment for each debt. Then, for the smallest debt, write down the monthly payment amount you can afford to pay above the minimum payment. This will be your snowball payment.

Each month, update the tracker with your payments and progress. As you pay off debts, you’ll see the snowball payment amount grow, allowing you to pay off larger debts more quickly. By consistently using the snowball tracker, you can stay on track with your debt payoff goals and see tangible results over time.

Benefits of Using a Snowball Tracker

There are several benefits to using a snowball tracker to monitor your debt payoff progress. Firstly, it provides a visual representation of your progress, which can help motivate you to stay on track and keep making payments. Seeing your debts decrease over time can be incredibly rewarding and encourage you to keep going.

Additionally, a snowball tracker helps you stay organized and keep all your debt payoff information in one place. By having a clear overview of your debts, payments, and progress, you can make informed decisions about where to allocate your money and which debts to focus on next. This level of organization can be key to successfully paying off debt and achieving financial freedom.