Managing your finances is crucial for achieving your financial goals and ensuring financial stability. One effective tool for managing your budget is a budget tracker printable. With a budget tracker printable, you can easily track your income, expenses, and savings in one convenient place.

By using a budget tracker printable, you can gain a better understanding of where your money is going each month and make informed decisions about your spending habits. This can help you identify areas where you can cut back on expenses and save more money for the future.

How to Use a Budget Tracker Printable

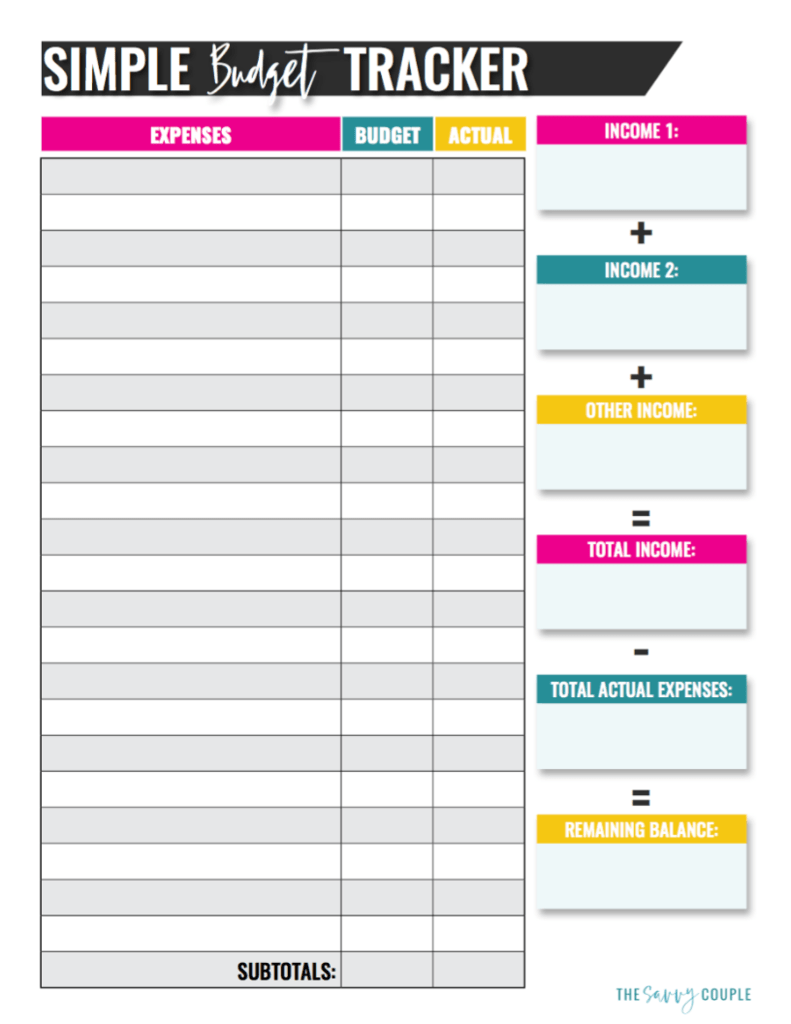

Using a budget tracker printable is simple and straightforward. Start by listing all your sources of income, such as your salary, bonuses, and any other income streams. Next, list all your expenses, including fixed expenses like rent and utilities, as well as variable expenses like groceries and entertainment.

Once you have listed all your income and expenses, subtract your total expenses from your total income to determine your net income. This will give you a clear picture of whether you are living within your means or if you need to make adjustments to your spending habits.

Benefits of Using a Budget Tracker Printable

There are several benefits to using a budget tracker printable. Firstly, it can help you stay organized and keep track of your finances in one central location. This can make it easier to see where your money is going and identify areas where you can cut back on expenses.

Additionally, using a budget tracker printable can help you set financial goals and track your progress towards achieving them. Whether you are saving for a vacation, a new car, or a down payment on a house, a budget tracker printable can help you stay on track and make informed decisions about your spending habits.