Keeping track of your finances is crucial for achieving financial goals and maintaining financial health. A financial tracker printable can help you stay organized and on top of your spending, saving, and budgeting. Here are some key benefits of using a financial tracker printable:

1. Easy to Use: A financial tracker printable is typically designed in a user-friendly format that allows you to easily input your financial data and track your progress over time. You can customize the tracker to suit your specific financial goals and needs, making it a valuable tool for managing your money effectively.

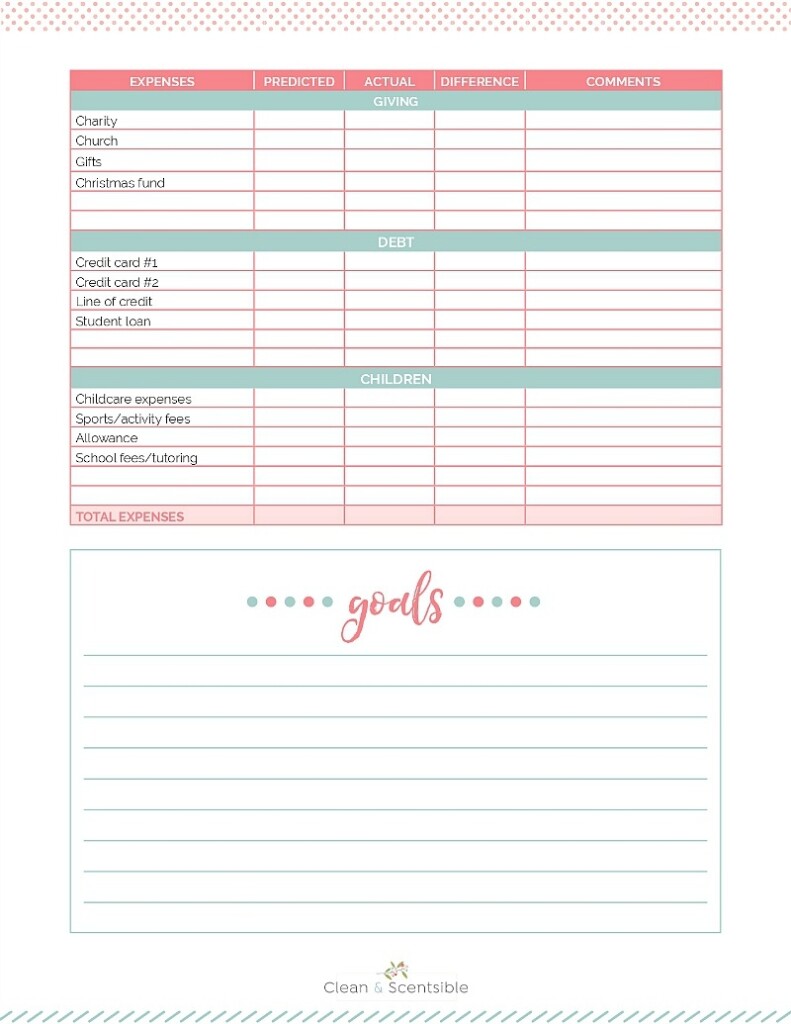

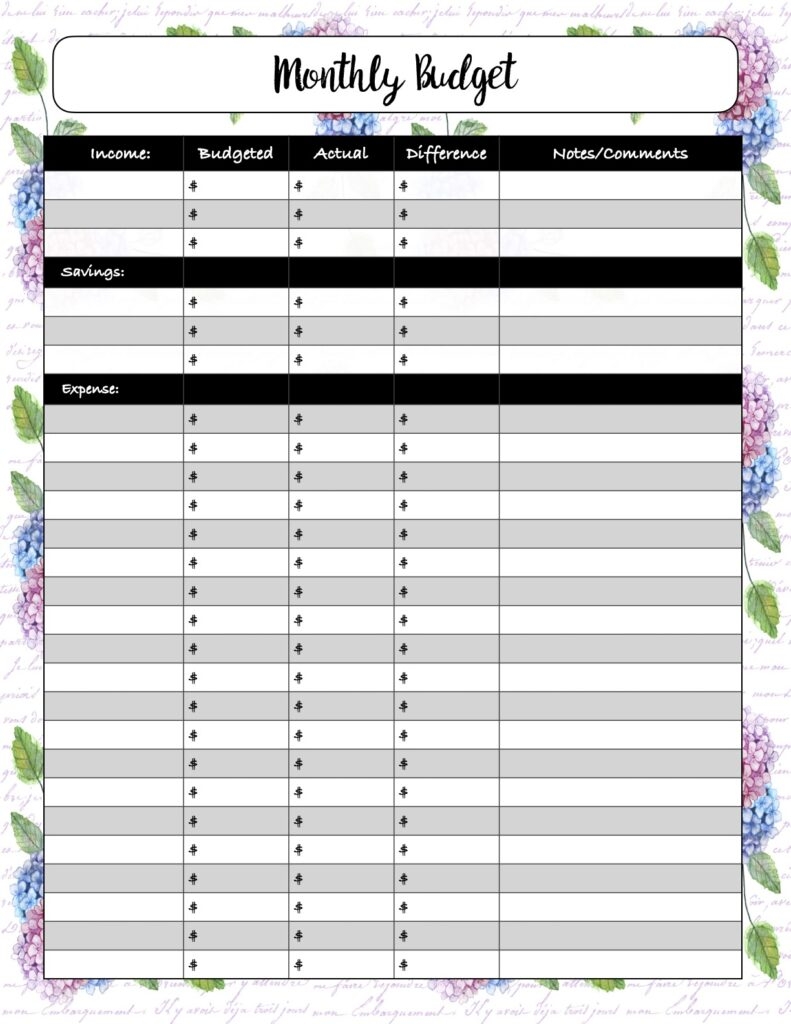

2. Visual Representation: Visualizing your financial information can help you understand your spending patterns, identify areas for improvement, and track your progress towards your financial goals. A financial tracker printable provides a visual representation of your financial data through graphs, charts, and tables, making it easier to analyze and interpret your financial information.

Tips for Using a Financial Tracker Printable

While using a financial tracker printable can be a powerful tool for managing your finances, it’s important to use it effectively to maximize its benefits. Here are some tips for using a financial tracker printable:

1. Set Clear Financial Goals: Before using a financial tracker printable, take the time to set clear financial goals for yourself. Whether you’re saving for a big purchase, paying off debt, or building an emergency fund, having specific financial goals will help you stay motivated and focused on your financial journey.

2. Track Your Spending Regularly: To get the most out of your financial tracker printable, make it a habit to track your spending regularly. Set aside time each week or month to update your tracker with your income, expenses, and savings. By staying consistent with your tracking, you’ll have a better understanding of your financial habits and be able to make informed decisions about your money.