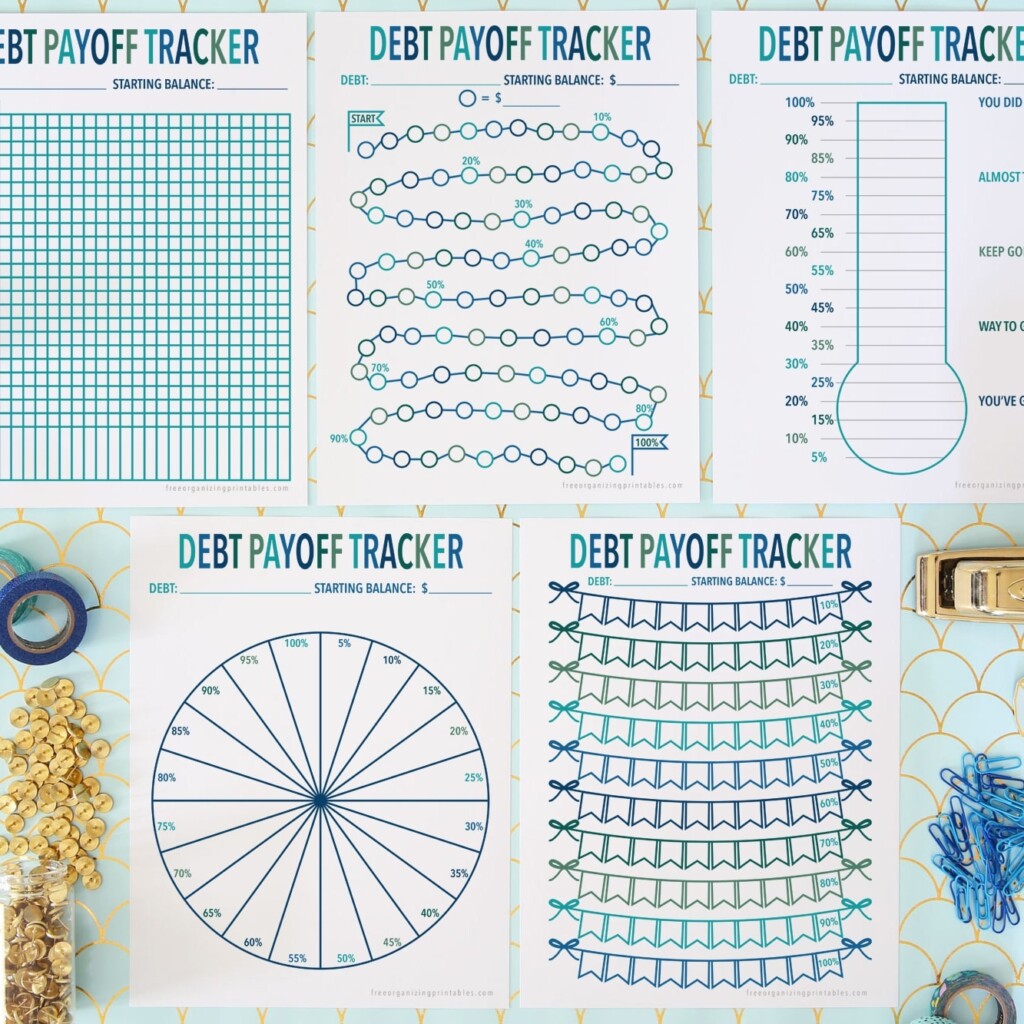

Managing debt can be overwhelming, but with the help of a free printable debt payoff tracker, you can take control of your financial situation. By tracking your progress, you can see how much you owe, how much you’ve paid off, and how much you have left to pay. This visual representation of your debt can help motivate you to stick to your repayment plan and reach your financial goals.

Using a debt payoff tracker is simple and effective. Simply download and print out the tracker, then fill in the necessary information, such as the name of the creditor, the balance owed, the interest rate, and the minimum monthly payment. As you make payments, update the tracker to reflect your progress. Seeing your debt decrease over time can be incredibly satisfying and can inspire you to continue on your debt-free journey.

Stay Organized

One of the key benefits of using a debt payoff tracker is that it helps you stay organized. By having all of your debt information in one place, you can easily see the big picture of your financial situation. This can help you prioritize your debts and create a repayment plan that works for you. Additionally, tracking your payments can help you avoid missing due dates and incurring late fees or additional interest charges.

Another advantage of using a debt payoff tracker is that it can help you identify areas where you can cut back on spending in order to put more money towards your debts. By seeing your debt laid out in front of you, you can make more informed decisions about where to allocate your financial resources. This can help you pay off your debts more quickly and efficiently, ultimately saving you money in the long run.

Take the First Step

If you’re ready to take control of your finances and start paying off your debts, download a free printable debt payoff tracker today. By tracking your progress, staying organized, and making informed decisions about your finances, you can achieve your financial goals and live a debt-free life. Don’t let debt hold you back any longer – take the first step towards financial freedom today.

Remember, using a debt payoff tracker is just one tool in your financial arsenal. It’s important to also create a budget, build an emergency fund, and explore other ways to increase your income and reduce your expenses. By taking a comprehensive approach to your finances, you can set yourself up for long-term success and achieve your financial goals.