Keeping track of your bills and payments is essential for maintaining financial stability and organization. A bill payment tracker printable can help you stay on top of your expenses and ensure that all of your bills are paid on time. By using a printable tracker, you can easily see which bills are due when, how much you owe, and when you’ve made a payment. This can help you avoid late fees, missed payments, and unnecessary stress.

Having a physical copy of your bill payment tracker can also serve as a visual reminder of your financial responsibilities. By keeping it in a visible location, such as on your fridge or bulletin board, you can easily reference it throughout the month and stay on top of your payments. Additionally, having a printed tracker allows you to easily make notes and track your progress, giving you a sense of accomplishment as you mark off each bill as paid.

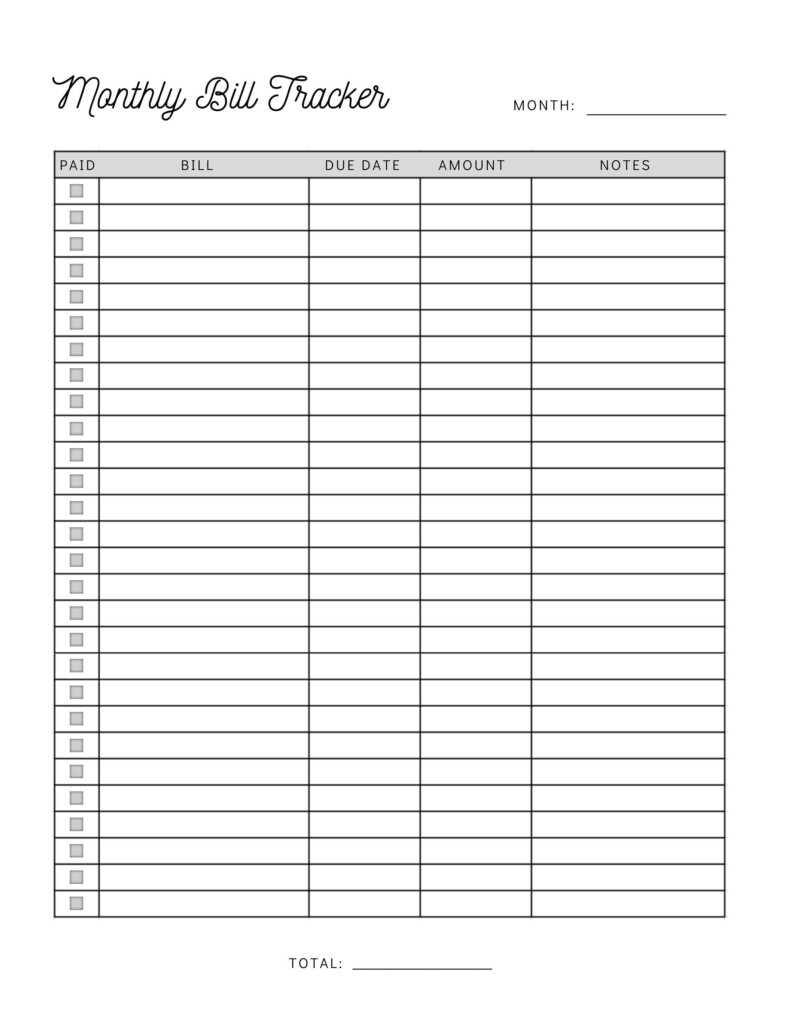

How to Use a Bill Payment Bill Tracker Printable

Using a bill payment tracker printable is simple and straightforward. Start by entering the name of each bill, the due date, and the amount owed in the designated columns. As you make a payment, mark the corresponding box or line to indicate that the bill has been paid. You can also add notes or reminders, such as confirmation numbers or payment methods, to keep track of important details.

It’s important to update your bill payment tracker regularly, ideally on a weekly or bi-weekly basis. This will help you stay organized and ensure that you don’t miss any payments. Set aside time each week to review your bills, make any necessary payments, and update your tracker accordingly. By staying consistent and proactive, you can effectively manage your finances and avoid any unnecessary late fees or penalties.

Benefits of Using a Bill Payment Bill Tracker Printable

There are several benefits to using a bill payment tracker printable. Firstly, it provides a visual representation of your financial obligations, making it easier to see at a glance which bills are due and when. This can help you prioritize your payments and budget accordingly. Additionally, having a physical copy of your tracker can serve as a tangible reminder of your financial goals and responsibilities, helping you stay motivated and accountable.

Using a bill payment tracker printable can also help you track your spending habits and identify areas where you can cut back or save money. By seeing all of your bills laid out in one place, you can easily identify any recurring expenses that may be unnecessary or excessive. This can help you make more informed decisions about your finances and work towards achieving your financial goals.